Medicare Part C - Medicare Advantage Plans

One of the options a Medicare beneficiary has as a resource to tackle Original Medicare’s Co-Insurance, Co-Pays, and Annual Deductibles is through the use of a Medicare Advantage plan, also known as Part C.

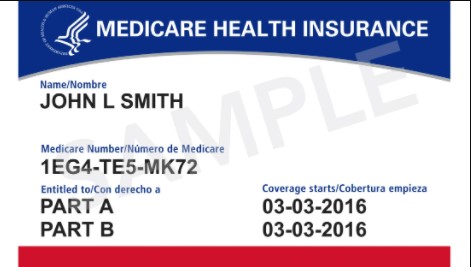

Medicare Advantage Plans are CMS (Center of Medicare Medicaid Services) approved insurance plans offered through private health insurance companies. They combine Original Medicare, Part A, Part B, and generally Part D into one plan. Enrolling in a Medicare Advantage plan requires a person to enroll in Medicare Part A & B and reside in the plan’s service area. Medicare Advantage plans, at a minimum, include all benefits, services, and coverages outlined in Original Medicare. They generally have additional benefits and services Medicare does not cover, such as:

- Preventative Care & Wellness Programs.

- Routine Hearing Exams & Hearing Aids.

- Routine Vision Exams & Corrective Lenses.

- Comprehensive Dental Coverage.

- Worldwide Emergency Assistance Outside The U.S.

Suppose a person enrolls in a Medicare Advantage plan. In that case, they must continue to pay the Original Medicare Part B premium. Still, plan premiums cost around $0 to $60 a month, depending on the plan chosen. A very affordable option to reduce the exposure to Medicare’s 20% co-insurance. By selecting a Medicare Advantage plan, the insurance company becomes your primary insurance, and by doing so, it has very distinct advantages and disadvantages, such as:

Advantages:

- It Has A Low or No Monthly Premium.

- Part D Is Generally Included In The Plan.

- It Provides Predictable Out-of-Pocket Costs.

- Usually Includes Extra Benefits Not Provided By Original Medicare.

Disadvantages:

- As A Rule, Working Within A Network Is Mandatory.

- Typically, Working With A Primary Care Physician Is Mandatory.

- In General, It Requires A Referral To See A Specialist.

Two types of Medicare Advantage plans are available to choose from: an HMO or PPO.

HMO – Health Maintenance Organization:

- Cover Eligible Services For Providers And Facilities Inside The Network Only, Except In An Emergency.

- As A Rule, Have A Very Narrow Network Confined To A Specified Geographical Area.

- In-Network Out-of-Pocket Expenses Are Limited.

- Out-of-Network Expenses Are Mostly Out-of-Pocket.

- Usually, Require A Primary Care Physician.

- Typically, Require A Referral To See A Specialist.

- Generally, Require Pre-Authorization For Procedures.

PPO – Preferred Provider Organization:

- Cover Eligible Services For Providers And Facilities Inside The Network.

- Cover Eligible Services For Providers And Facilities Outside The Network.

- As A Rule, Have A Broad Network With Nation Wide Coverage.

- In-Network Out-of-Pocket Expenses Are Limited.

- Out-of-Network Out-of-Pocket Expenses Are Limited.

- Usually, Do Not Require A Primary Care Physician.

- Typically, Do Not Require A Referral To See A Specialist.

- Generally, Do Not Require Pre-Authorization For Procedures.

Choosing a Medicare Advantage plan does not mean a person is bound indefinitely to the Medicare Advantage plan. There are enrollment timelines when a person can change their coverage if needed or wanted.

Medicare Advantage Plan Enrollment Timelines.

Annual Election Period Oct 15th – Dec 7th: Compare And Find The Best Plan For The Next Calendar Year.

Coverage Changes Available:

- Change To A Different Medicare Advantage Plan.

- Switch From A Medicare Advantage Plan To Original Medicare.

- Switch From Original Medicare To A Medicare Advantage Plan.

- Change, Join, or Drop Part D Prescription Drug Coverage.

- Coverage Will Become Effective On Jan 1st.

Open Enrollment Period Jan 1st – Mar 31st: Set Aside For People Enrolled In A Medicare Advantage Plan.

Coverage Changes Available:

- Change To A Different Medicare Advantage Plan.

- Switch From A Medicare Advantage Plan To Original Medicare.

- Join A Separate Part D Prescription Drug Plan.

- Changes Are Available Once During This Time.

- Coverage Will Become Effective The 1st Of The Following Month.

Lock-In Period Apr 1st – Dec 31st: No Plan Changes Allowed Unless A Qualifying Event Creates A Special Election Period.

Such As:

- Moving Outside A Plan’s Service Area.

- Losing Employer Group Coverage.

- Qualify For The Medicare Savings Plan (Medicaid For Over 65).

- Qualify For Extra Help With Prescription Drug Costs (LIS).

Loss Of Special Needs – Extra Help or Medicare Savings Plan.