Medicare Options

Combating The Unlimited Financial Exposure

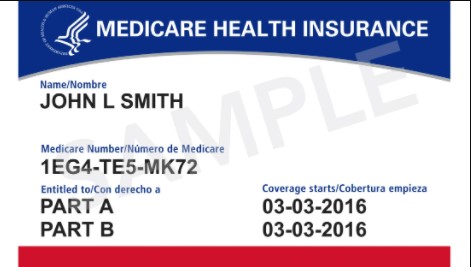

After enrolling in Original Medicare Parts A & B, it is imperative to understand that Original Medicare is an eighty/twenty plan. Meaning Medicare only pays 80% of covered medical expenses, and the Medicare beneficiary is responsible for the remaining 20% of the costs for Medicare Part A and B. There is no cap for the 20% a beneficiary is liable to pay. Only having Original Medicare puts people at an unlimited financial exposure. Additional coverage is possibly the most crucial decision one can make after enrolling in Medicare.

Exploring these Medicare options is where most of the confusion about Medicare starts. First, it is optional, but given the affordability of one of the options, it is not advisable to dismiss how it can help combat the excess Medicare expenses. Second, of the two choices, one option is managed health care, and the other is not. Understanding the advantages and disadvantages of each option is vital. Finally, Medicare Part D, prescription drug coverage, is another determination because it is optional, just like supplemental insurance. But, opting out of Medicare Part D when first eligible will create a lifetime CMS (Center of Medicare Medicaid Services) penalty to the monthly premium if a person enrolls in prescription drug coverage later.

Available Options

Option 1 – Medicare Supplement Insurance – aka Medigap

Medigap Plans is one of the Medicare options available to help reduce the 20% exposure left by Original Medicare. They are CMS approved insurance plans offered through private health insurance companies. They can ease some, or almost all, of the expenses associated with copayments, coinsurance, and deductibles. Medigap policies can also offer coverage for services that Original Medicare doesn’t cover. For instance, medical care when traveling outside the United States. With Original Medicare and a Medigap policy, Medicare will pay its share of Medicare-approved amounts, and the Medigap policy pays its share.

Advantages:

- The Primary Insurance Is Medicare – There Are Absolutely No Networks To Adhere Too.

- If The Doctor, Facility, or Hospital Accepts Medicare, The Medigap Plan Must Accept Them.

Disadvantages:

- Paying An Additional Monthly Premium Regardless Of Going To The Doctor or Not.

- Generally, The Monthly Premium Will Increase Every Year With Age.

- Part D Is Another Separate Plan With Another Separate Premium.

Medigap plans cost around $100 to $150 a month, depending on the plan chosen. Depending on the plan chosen, prescription drug plans cost around $20 to $70 a month.

Option 2 – Medicare Part C – Medicare Advantage Plans

Medicare Advantage Plans is one of the Medicare options available to help reduce the 20% exposure left by Original Medicare. They are CMS approved insurance plans offered through private health insurance companies. They combine Original Medicare, Part A, Part B, and generally Part D into one plan. Enrolling in a Medicare Advantage plan requires a person to enroll in Medicare Part A & B and reside in the plan’s service area. Two types of Medicare Advantage plans are available to choose from: an HMO or PPO. Medicare Advantage plans, at a minimum, include all benefits, services, and coverages outlined in Original Medicare. They generally have additional benefits and services Medicare does not cover, such as:

- Preventative Care & Wellness Programs.

- Routine Hearing Exams & Hearing Aids.

- Routine Vision Exams & Corrective Lenses.

- Comprehensive Dental Coverage.

- Worldwide Emergency Assistance Outside The U.S.

Advantages:

- It Has A Low or No Monthly Premium.

- Part D Is Generally Included In The Plan.

- It Provides Predictable Out-of-Pocket Costs.

- Usually Includes Extra Benefits Not Provided By Original Medicare.

Disadvantages:

- As A Rule, Working Within A Network Is Mandatory.

- Typically, Working With A Primary Care Physician Is Necessary.

- In General, It Requires A Referral To See A Specialist.

Medicare Part D – Prescription Drug Plans

Part D Prescription Drug Plans are CMS approved plans offered through private health insurance companies. These plans are either found as a Stand-Alone Prescription Drug Plan or a Medicare Advantage Prescription Drug Plan (MAPD). They cover brand-name and generic medications supplied by a pharmacy. Coverage varies by plan, and each plan has a formulary. A formulary is a list of the drugs covered by that plan.

With all this said, please review the Medicare 101 page, ‘The Four Parts of Medicare Plus Supplemental,’ to receive a more in-depth explanation of your Medicare options.